clearlaw

Victoria's long wait has begun - New CIPT outcomes for commercial and industrial land transactions

Victoria’s new Commercial and Industrial Property Tax (CIPT) regime commenced on 1 July 2024 (Commencement Date) as the government seeks to replace stamp duty on commercial and industrial property transactions. All property classified as ‘Commercial or Industrial Property’ that enter the new regime will be subject to a 1% annual tax (in addition to land tax) 10 years after entering the regime.

This article expands further on our previous article published in June 2023 and outlines the legislative changes which have been subsequently introduced, key issues to be aware of, and outlines some different scenarios in which CIPT may apply.

Tristram Feder, Maddocks LawyersHow will CIPT affect purchasers of commercial and industrial property?

From 1 July 2024, any ‘Commercial or Industrial Property’ (CIP) which is the subject of a certain transaction (generally those that attract duty) will enter the new CIPT regime (known as ‘Entry Transactions’). From this date CIP can also enter the new regime where a consolidation or subdivision of land occurs.

CIP is defined as land that has a ‘qualifying use’ under the Australian Valuation Property Classification Code (AVPCC). Each separate occupancy on a property is allocated an AVPCC under the Valuation of Land Act 1960 (Vic), which is displayed on the council rates valuation notice for the property.

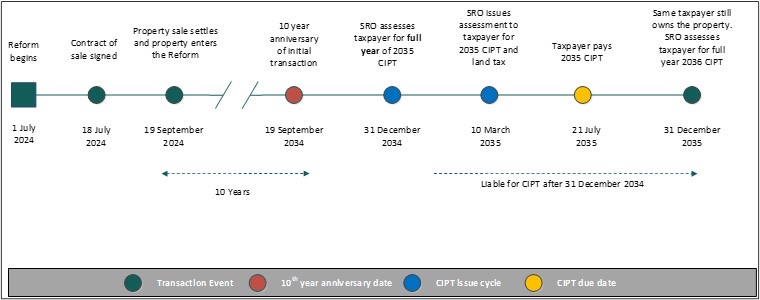

Following the 10 year anniversary of the Entry Transaction, the CIP land will become liable to a yearly tax equal to 1% of the unimproved value of the land.

The diagram below from Treasury sets out this process:[1]

Entry Transactions will still be subject to duty (e.g. transfer duty for dutiable transactions or landholder duty for ‘relevant acquisitions’). However, the duty can either be paid upfront as per usual or via fixed instalments over a 10 year period under a government facilitated loan to fund the payment of duty (for eligible purchasers). These 10-year payment arrangements for duty are referred to as ‘Transition Loans’.

Subsequent transactions in relation to CIP that have been subject to an Entry Transaction and have entered the new regime will no longer be subject to duty, as long as the CIP continues to have a ‘qualifying use’ (as commercial or industrial property) under the AVPCC at the time of the transaction.

It should be noted that CIP only enters the regime upon being transacted, so any CIP currently being used for commercial or industrial purposes that is not sold will not be subject to the new regime until the next time it is sold.

How will Transition Loans operate?

The Treasury Corporation Victoria (TCV) may provide Transition Loans to eligible purchasers that are liable for duty on an Entry Transaction. To be eligible for Transition Loans, purchasers will need to be:

- Australian citizens, permanent residents or an Australian business;

- the first purchaser of CIP on or after 1 July 2024;

- acquiring CIP which is valued at under $30 million with a maximum of $1.93 million in duty [2]; and

- approved for finance from an authorised deposit-taking institution or other approved lender for the CIP.

The Transition Loans will be secured by a first ranking charge on the land in favour of the TCV and will be repayable over a 10 year period (Loan Period). The Transition Loans will attract interest at the TCV bond rate and a credit risk margin over the Loan Period[3].

If a purchaser does not satisfy the above criteria, then 100% of the duty liability must be paid.

If property is sold prior to the end of the Loan Period, the outstanding balance of the Transition Loan will become payable at the time the secondary sale occurs.

Examples of the application of CIPT

Some examples are as follows:

- In transactions where two separate titles are sold as part of one transaction, one in respect of CIP land and the other residential land, only the CIP will enter the CIPT regime.

- In a situation where a purchaser acquires 75% of shares in a company holding CIP , the purchaser will pay landholder duty as per usual on the CIP and 100% of the CIP will enter the CIPT regime.

Why is it important to get legal advice?

The new CIPT regime is complex and there are specific rules for partial sales, mixed use land and changes of use of CIP land between a qualifying use and a non-qualifying use (such as residential use). Different scenarios will require analysis to determine if the land is entering the new regime or not. Given the variety of situations, you should seek legal advice if you a transaction involving CIP land will take place or if you require clarification about any of the points raised in this article.

More information from Maddocks

For more information, contact Maddocks on (03) 9258 3555 and ask to speak to a member of the Commercial team.

More Cleardocs information on related topics

- Victorian State Budget: Commercial Stamp Duty Shape-Up And The COVID Debt Repayment Plan

- NSW Scraps First Home Buyer Choice Program

- SMSF Trustees: Why Should I Use a Corporate Trustee

Order related document packages

[1] Diagram sourced from Department of Treasury and Finance Victoria, Commercial and Industrial Property Tax Reform – Information Sheet

[2] Calculated on a per title basis.

[3] For more details visit this Link

Read Our Latest Articles

Professional adviser related

Crypto Crackdown: ASIC’s $14m Win Against Qoin Sets New Regulatory Benchmark

Professional adviser related

Advice Matters: ASIC targets SMSF auditors amid rising compliance failures

Professional adviser related

ASIC Tightens Privacy: Residential Addresses Removed from Purchased Company Extracts

customer support

legal advice

-

The legal information and commentary on this site is general only. Documents ordered through Cleardocs affect the user's legal rights and liabilities. To assess their suitability for the user, legal accounting and financial advice must be obtained.