SMSF Deed: version history

The Cleardocs SMSF Trust Deed, along with all other Cleardocs documents, is regularly enhanced to ensure it aligns with current laws.

This means that if there are changes in the law, the Cleardocs Deed is reviewed and updated accordingly.

Each time the Deed is updated, Cleardocs allocates a new version number.

Which version is my Cleardocs Superannuation deed?

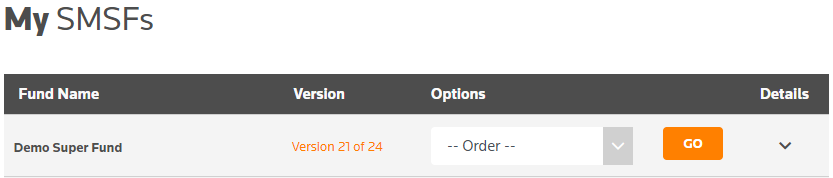

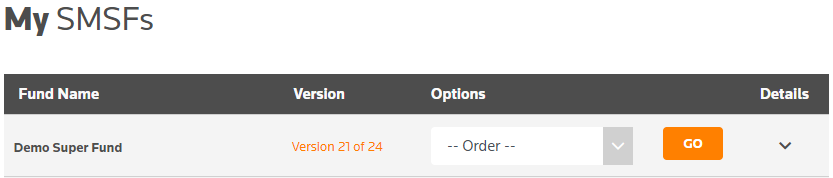

To check your Cleardocs superannuation version number:

- Log into Cleardocs

- Click onto your email address (top right-hand corner)

- From the drop-down menu, select "My SMSFs"

- You will see all the SMSF’s created and their version number.

In the example below, the fund has a Cleardocs Deed which is version 21. The latest version of the Deed is version 24.

What is the difference between the versions of the Deed?

When you click on the "Version X of Y" button, you can view:

- the date that each version of the Cleardocs Deed was released.

- the changes incorporated in each version of the Deed.

These details are summarised in the below table:

| Version |

Date Of Release |

Changes Included |

| 25 |

21 August 2025 |

- Meeting provisions: updated meeting provisions under the deed for trustee meetings, and to accommodate information meetings for members, including by updating technology provisions and allowing the trustees to adopt rules for using technology.

- Notice provisions: modernised notice provisions to clarify service requirements, updating details and service rules for electronic notices. Alongside updates to electronic signing provisions, and extending those to signing of other fund-related documents.

- COVID: removing final legacy clauses relating to the COVID pandemic and associated regulations.

- First home super saver scheme: updating fund account and investment strategy provisions to provide greater guidance for trustees on accommodating members with FHSS balances.

- Fund employer provisions: simplifying fund employer provisions to reflect much reduced rates of funds with named employers.

- No more anti-detriment provisions: removal of anti-detriment provisions, reflecting their cessation at law.

- Professional advisors: simplifying the provisions relating to the trustee’s appointment and removal of professional advisors, and preparation of financial statements.

- Winding-up provisions: improving the fund wind-up provisions in relation to costs and liabilities of the fund.

|

| 24 |

12 October 2023 |

- Deed updated so trustees can receive payments in accordance with "Non-Arm's Length Expenses" (NALE) rules

- Deed updated to provide that employer sponsor contributions will terminate where the employer, being an individual, dies

- Deed updated to clarify provisions in relation to total and permanent disablement and retirement provisions

- PDS updated to current financial year

|

| 23 |

11 October 2022 |

- PDS updated to current financial year (1/7/22)

- Removal of provisions on forfeiture of benefit entitlements

- Removal of references to Binding Death Benefit Nomination three year expiry and addition of new provisions following High Court decision in Hill v Zuda

- Updated general execution clauses

|

| 22 |

17 Mar 2022 |

- Amendment of signing clauses to ensure they are expressed as signed under a 'deed' if the party is a company

|

| 21 |

23 July 2020 |

|

| 20 |

1 July 2019 |

- Ability to select whether members of the fund wish to appoint their legal personal representative as a trustee for the period commencing when the member dies and ending when the member's death benefits are distributed.

- PDS updated to current financial year.

|

| 19 |

1 July 2018 |

- PDS updated to current financial year

- Reporting Transfer Balance Account Events information and requirements

|

| 18 |

1 July 2017 |

- PDS updated to current financial year

- broaden trustee's powers around conflicts of interest in response to Bank requirements and investment activities

|

| 17 |

23 February 2017 |

- Deed updated to reflect variety of changes to the law as part of 2017 Superannuation System reforms.

- Changes included:

- Introduction of $1.6m transfer balance cap.

- New death benefit roll-over rules.

- New commutation rules.

- Phasing out of anti-detriment payments.

- PDS updated in relation to tax rates, contribution caps and managing the $1.6m transfer balance cap, new contribution rules and transition to retirement pension changes.

|

| 16 |

1 July 2016 |

- PDS updated to current financial year.

|

| 15 |

1 July 2015 |

- PDS updated to current financial year.

|

| 14 |

1 July 2014 |

- PDS updated to current financial year.

|

| 13 |

10 September 2012 |

- Deed now allows an SMSF member to include within their Death Benefit Agreement or Death Benefit Nomination how any amount payable under the fund will be distributed if a beneficiary or beneficiaries predecease the member.

- Deed updated to reflect changes to the law about SMSF investment strategies. You can read a ClearLaw article about the changes to the law here

- Clauses updated in relation to commuting pensions.

- Deed updated to reflect recent changes to how the Tasmanian State Revenue Office assesses duty on trust deeds.

|

| 12 |

29 June 2012 |

- Deed updated to reflect changes to the law allowing an SMSF with a corporate trustee and members less than 18 years of age.

- The above changes were made by the Tax Laws Amendment (2011 Measures No. 9) Act 2012.

- The law received Royal Assent on 21 March 2012 and took effect on that date.

- PDS updated for 2012-13 financial year.

|

| 11 |

9 July 2010 |

- Deed updated to reflect changes to the law about SMSF Borrowing.

- Those changes were made by the Superannuation Industry (Supervision) Amendment Act 2010.

- The law received Royal Assent on 6 July 2010 and took effect on 7 July 2010.

- The updated version of our deed was in place from Friday 9 July 2010.

- You can read a ClearLaw article about the date the changes took effect here — that article has a link to an article summarising the changes.

|

| 10 |

26 November 2009 |

- New execution clauses to meet bank requirements.

- Signing by authorized representative has been removed and replaced with the clauses stipulated in s126 of the Corporations Act, 2001, which banks prefer.

|

| 9 |

4 May 2009 |

- Deed now allows Death Benefit Agreements which SMSF members can use to arrange binding Death Benefit Agreements that do not lapse after 3 years - the agreement binds the trustee(s) until the member revokes it or replaces it. Many SMSF members want to bind their trustees as to how their benefits are to be paid after they die. The trouble is, superannuation law requirements say that after 3 years, a binding death benefit nomination expires. After it expires, the trustees (or other directors of the trustee) are free to distribute the relevant money anyway they like that the law allows - often, even to themselves. Death Benefit Agreements overcome the 3 year restriction.

- Death Benefit Agreements are also available on Cleardocs.

|

| 8 |

31 January 2008 |

- Deed now specifically mentions 'Instalment Warrants' - this will help trustees who apply for a loan to acquire assets for their SMSF. (All earlier versions of the Cleardocs SMSF deed have a general borrowing power which allows borrowing through an instalment warrant - but because banks etc. may require a specific power, we added a specific power.)

|

| 7 |

21 September 2007 |

- Transitional provisions removed.

- 'Better Super' changes for 1 July 2007 and 20 September 2007 have been in all Cleardocs deeds since Version 6 (23 April 2007), see below.

|

| 6 |

23 April 2007 |

- PDS now accurately reflects the law in force from 1 July 2007 (as curently legislated) including transitional provisions effective until 20 September 2007

|

| 5 |

18 October 2006 |

- Deed ready for the government's Plan to Simplify and Streamline Superannuation - which is due to become law on 1 July 2007

- Specific pension payment clauses removed as the pension types are now obsolete

|

| 4 |

18 April 2006 |

- Lump sum payments in retirement for individual trustees without first paying a pension

|

| 3 |

11 November 2005 |

- Contribution Splitting and Transition to Retirement pensions

|

| 2 |

- |

|

| 1 |

- |

- Disablement benefits payable to members

- Death benefits payable to members

- Choice of binding or non-binding death benefit notices

- Reserve and forfeiture account options as allowed under legislation at the time

- Full range of reserving/pension payment options as allowed under legislation at the time

- Investment choice by members

|

Any questions?

If you have any questions about your SMSF Trust Deed or how to use Cleardocs, contact the Cleardocs helpdesk on 1300 307 343.