clearlaw

Family Trusts and end-of-year distributions - Revisiting the benefits of the 'Bucket Company' structure

Discretionary trusts are commonplace in family investment structures due to the various benefits they provide. These benefits include tax planning and savings, legal asset protection and flexibility for trustees as to the distribution of income and capital of the trust.

In the lead-up to the end of each financial year, trustees are required to determine how the income of its discretionary trust will be distributed, effectively determining who will receive (and pay tax on) the trust's income for that year. Making distributions to a corporate beneficiary, otherwise known as a 'Bucket Company', is an effective strategy that can be implemented as a means to maximise tax saving benefits by ensuring that the amount of tax paid on the balance of the discretionary trust's income, being the income that is not distributed to the other (preferred) beneficiaries due to tax considerations, aligns with the company tax rate of 30%.

This article will provide an overview of how Bucket Company structures operate as well as providing guidance for trustees who wish to implement their own Bucket Company structure.

Sam McKenzie, Maddocks LawyersWhat is a 'Bucket Company'?

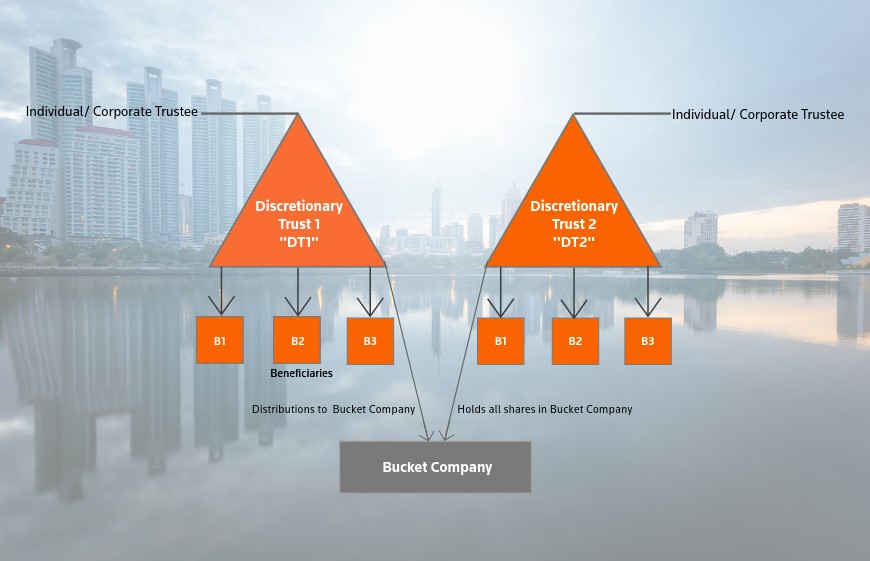

A 'Bucket Company' is a proprietary limited company that is set up as a beneficiary of an existing discretionary trust (DT1), thus enabling the trustee of DT1 to distribute income to the Bucket Company. The shareholder(s) of the Bucket Company - in their capacity as trustee(s) of a separate discretionary trust (DT2) - are then paid fully-franked dividends at a later point in time, which sums are in turn distributed to the beneficiaries of DT2 (being the same or similar entities as the beneficiaries of DT1).

The integration of a Bucket Company into an existing family trust structure can be illustrated by way of the following diagram and is explained in more detail in this article

What is the benefit of the Bucket Company structure?

By having a Bucket Company as an eligible beneficiary of DT1, the trustee of DT1 may make distributions of the income of DT1 to the Bucket Company where eligible (and preferred) beneficiaries of DT1 have already received income which is taxed at their marginal tax rates, particularly where a beneficiary has reached a level of income being taxed at the highest marginal rate. Accordingly, this enables the trustee to take advantage of the corporate tax rate (currently at 30%), to the extent that the corporate tax rate is less than the relevant marginal tax rate. This can be achieved by distributing the balance of the income of DT1 to the Bucket Company, effectively capping the tax payable on DT1's income at the corporate tax rate.[1]

The income distributed to the Bucket Company can remain in the Bucket Company until it is considered advantageous from a tax perspective to distribute this income to the shareholder(s) of the Bucket Company, by way of fully franked dividends. As illustrated in the diagram above, the only shareholder of the Bucket Company (i.e., the recipient of the dividends) will be the trustee(s) of DT2 with the same or similar named beneficiaries as DT1 and that has been established specifically for the purpose of receiving the passive dividends from the Bucket Company.

By distributing the income of the Bucket Company as a fully franked dividend, the Bucket Company ensures that the beneficiaries of DT2 will receive a franking credit on the tax that the Bucket Company has already paid on the dividends. This effectively ensures that the beneficiaries of DT2 will not be required to pay tax on the proportion of the dividend on which the Bucket Company has previously paid tax.

Adopting this structure effectively permits the income of DT1 to be distributed to the beneficiaries of DT1 at a later time as fully franked dividends. Ideally, these distributions will be made at a time when the beneficiaries' marginal tax rates are near or below 30%.

How does the Bucket Company structure apply in practice?

By way of example, let's assume that a business operated in DT1, being a discretionary trust with four individuals as named beneficiaries, made a profit of $2,000,000 for the 2023-24 financial year. For the purposes of this example, we have assumed that the individual beneficiaries of DT1 have no other source of income.

If the entirety of the profit was paid in equal parts to the four named beneficiaries as individuals (i.e., with no Bucket Company structure in place), under the 2023-24 financial year tax rate, the individuals would each pay $195,667 of tax (excluding payments in relation to the Medicare levy and superannuation contributions).

Conversely, if a Bucket Company structure was adopted, the trustee of DT1 may determine to distribute, say, $45,000 in profits to each of the four individuals (which fully utilises their personal marginal tax rate of 19%). The individuals would pay zero tax on the first $18,200 and 19c for each dollar beyond the first $18,200. Therefore, the individual beneficiaries would each pay $5,092 of tax. The balance of the income in DT1, being $1,820,000, may then be distributed to the Bucket Company, which would pay the corporate tax rate, being 30%. Accordingly, the Bucket Company would pay $546,000 tax on this income.

In this example (which is rather simplistic for the illustrative purposes):

- the tax paid in the 2023-24 financial year on the income of DT1 without a Bucket Company structure would be $782,668; and

- the tax paid in the 2023-24 financial year on the income of DT1 with a Bucket Company structure would be $566,368.

Therefore, the tax savings from implementing the Bucket Company structure in this example would be $216,300.

Does my existing family trust structure permit a Bucket Company structure?

A Bucket Company structure may only be implemented if the trust deed of the existing discretionary trust permits the Bucket Company to fall within the general class of beneficiaries. Therefore, it is imperative that before adopting the Bucket Company structure the existing trust deed is read and understood to ensure that there is scope for the Bucket Company to fall within the general class of beneficiaries (i.e., the trustee may distribute income to the Bucket Company). If your existing discretionary trust deed is a standard Cleardocs 'Discretionary (Family) Trust' then, provided the correct persons are directors or shareholders of the Bucket Company, then the Bucket Company will be within the class of eligible beneficiaries.

If the existing discretionary trust:

- is not established through Cleardocs; or

- is established as a trust which prevents distributions to 'foreign persons',[2]

then it is pivotal to ensure that the Bucket Company complies with the restrictions of the discretionary trust deed when it is established.

Conversely, if the existing discretionary trust deed is a Cleardocs deed which only permits distributions to blood relatives of the named beneficiaries, then you cannot use the 'Bucket Company' product.

Cleardocs Bucket Company product

The Cleardocs Bucket Company product bundle includes the following documents:

- electronic bucket company registration and company set up documents;

- new discretionary trust set up;

- ABN registration for the new discretionary trust;

- income distribution minutes template for your new discretionary trust;

- two Division 7A loan agreements; and

- an Establishment Kit explaining what to do next.

The Cleardocs Bucket Company product assumes that you already have a discretionary trust in place. The Bucket Company then becomes an eligible beneficiary of that existing discretionary trust. If you do not have a discretionary trust in place, you must first create a discretionary trust.

We note that this product may be used even if your existing discretionary trust does not have a Cleardocs deed. However, if the existing discretionary trust deed is not a Cleardocs deed we reiterate the importance of ensuring that the Bucket Company will fall within the general class of beneficiaries of the discretionary trust.

More information from Maddocks

For more information, contact Maddocks on (03) 9258 3555 and ask to speak to a member of the Commercial Practice Group.

More Cleardocs information on related topics

You can read earlier ClearLaw articles on a range of trust topics.

Order related document packages

- Discretionary Trust - Bucket Company

- Discretionary (Family) Trust

- Discretionary Trust - excluded beneficiaries

- ABN Registrations - trusts

- Unit Trust - fixed

- Unit Trust - non-fixed

- Hybrid Trust

- Change of Trustee Discretionary Trust

- Change of Trustee Unit Trust

- Discretionary Trust Distribution Minute

[1] Subject to legislative amendments to the corporate tax rate.

[2] This term is defined by reference to a range of definitions in Australian law including the duties act of each state and territory.

Read Our Latest Articles

customer support

legal advice

-

The legal information and commentary on this site is general only. Documents ordered through Cleardocs affect the user's legal rights and liabilities. To assess their suitability for the user, legal accounting and financial advice must be obtained.