This article is more than 36 months old and is now archived. This article has not been updated to reflect any changes to the law.

clearlaw

Action required for unpaid present entitlements subject to 7 year sub-trust arrangements

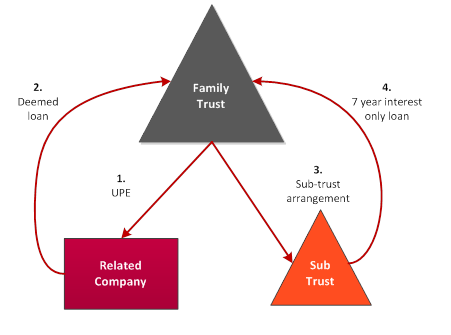

Prior to 30 June 2011, family groups had several options to deal with unpaid present entitlements (UPEs) owed by a family trust to a related company. One option was to place the funds representing the UPE on a sub-trust arrangement. The sub-trust could then loan the funds (interest only) back to the family trust for 7 years. Family groups which used this sub-trust option need to deal with the funds soon or risk a Division 7A deemed dividend arising.

Daniel Hui, Maddocks LawyersOn 19 July 2017, the Australian Taxation Office (ATO) released Practical Compliance Guideline PCG 2017/13 (PCG 2017/13) as a reminder to those family groups that used the 7 year sub-trust option under Practice Statement Law Administration PS LA 2010/4 (PS LA 2010/4). Broadly, those arrangements worked as follows:

OK, what do family groups need to do now the 7 year period is about to expire?

PCG 2017/13 provides guidance on the administration of sub-trust arrangements once the 7 year loan period expires, and states that:

- once the 7 year period has expired, the trustee of the family trust must actually repay the principal of the loan to the sub-trust (and/or terminate the sub-trust and pay the funds to the related company);

- if the trustee of the family trust "fails" to meet this obligation and does not repay the principal of the loan to the sub-trust, then this will be treated as a new loan for the purpose of Division 7A from the related company to the family trust;

- the related company and the family trust must record this loan as a 7 year Division 7A loan on complying terms. This will provide a further period for the amount to be repaid with periodic payments of both principal and interest; and

- if the unpaid principal of the loan is not put on complying terms by the lodgement day of the company's income tax return, a deemed dividend will arise at the end of the income year in which the loan matures.

Finally, PCG 2017/13 states that where the facts and circumstances indicate that there has never been an intention to repay the principal loan at the end of the 7 year interest-only loan, the Commissioner may consider that the purported arrangement was a sham, and/or that there was fraud or evasion. In these circumstances, the Commissioner may go back beyond the standard period of review and deem a dividend in the income year in which the provision of loan initially arose.

Action required — and when

As family groups had until 30 June 2011 to enter into sub-trust arrangements, the 7 year loan period will expire no later than 30 June 2018. However, family groups may have entered into the sub-trust arrangement earlier and the 7 year period may be closer to expiring (if it has not done so already).

Family groups should review their Division 7A arrangements for any 7 year sub-trust arrangements. To the extent any 7 year sub-trusts have been put in place, family groups and their advisors should consider:

- repaying the principal amount to the sub-trust or the related company once the 7 year period expires; or

- converting the unpaid principal amount into a 7 year Division 7A loan on complying terms before the lodgement day of the company’s income tax return.

More information from Maddocks

For more information, contact Maddocks on (03) 9258 3555 and ask to speak to a member of the Revenue Practice Group.

More Cleardocs information on related topics

You can read earlier ClearLaw articles on a range of matters.

You can read Practical Compliance Guideline 2017/13 here.

Order Cleardocs products

Read Our Latest Articles

customer support

legal advice

-

The legal information and commentary on this site is general only. Documents ordered through Cleardocs affect the user's legal rights and liabilities. To assess their suitability for the user, legal accounting and financial advice must be obtained.