This article is more than 36 months old and is now archived. This article has not been updated to reflect any changes to the law.

clearlaw

Division 7A and Unpaid Present Entitlements: determining the amount of a deemed entitlement

The ATO has released a draft determination discussing the factors the Commissioner will consider when determining the amount of any unpaid present entitlement arising if a private company's entitlement to trust income is through interposed trusts.

The Draft Taxation Determination sheds light on the workings of section 109XI of the Income Tax Assessment Act 1936 (ITAA 36) which was introduced on 29 June 2010 and which took effect from 1 July 2009.

Anna Tang and Nicole SiemensmaThe importance of the Draft Taxation Determination

The notion of unpaid present entitlements through interposed trusts is a very complex area within tax legislation. This Draft Taxation Determination enables private companies and trustees:

- to better understand how the Commissioner calculates an amount a private company is entitled or deemed entitled to receive from a target trust; and

- to understand what types of payments will not be considered when calculating unpaid present entitlements under section 109XI. An example of such a payment is an amount that has been included in the assessable income of a shareholder of a private company under another provision of Subdivision EA.

Remind me: how does Division 7A work?

If Division 7A of the ITAA 36 applies, then certain payments, loans and forgiven debts that a private company arranges for its shareholders or their associates are deemed to be unfranked dividends. You can read a brief outline of Div 7A here

Remind me: what is an 'unpaid present entitlement'?

An 'unpaid present entitlement' is a distribution from a trust that a trustee has decided to make, but has not yet paid out. It also applies to an amount not yet paid out of a sub-trust.

For further information please see ClearLaw article 'The ATO shifts its view on Division 7A loans and unpaid trust entitlements'.

Remind me: how do sections 109XA and 109XI work?

Section 109XA of the ITAA 36 deems a private company to have made a payment, loan or forgiven a debt owing to an entity (target entity) for Division 7A purposes if the following conditions are satisfied:

- a trustee makes a payment, loan or forgives a debt owing to a shareholder, or an associate of a shareholder, of a private company; and

-

in the case of a payment:

- the payment is wholly or partly to pay an amount that the shareholder, or associate, is entitled to from the trust; and

- that entitlement is wholly or partly attributable to an amount that is an unrealised gain of the trust; and

- the company is, or becomes, presently entitled to an amount from the net income of the trust estate at the time the payment, loan or debt forgiveness takes place; and

- the whole of the amount the company is entitled to has not been paid to the company before the earlier of the date the trustee's tax return is due to be lodged or the date it is lodged.

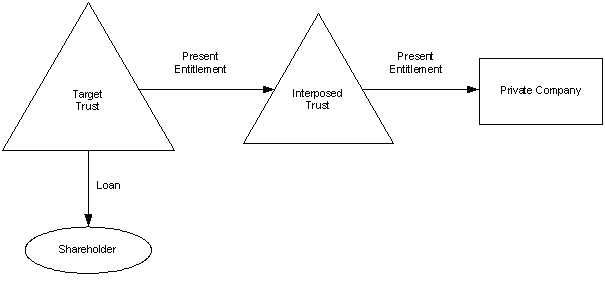

Section 109XI was introduced to prevent taxpayers circumventing the operation of section 109XA by interposing one or more trusts between the trustee and the private company. The diagram below, shows how the circumventing arrangement worked. (The diagram further below shows how that circumvention no longer works.):

Section 109XI was introduced in on 29 June 2010 and came into effect on 1 July 2009. The effect of the section is to provide that a private company is deemed to be presently entitled to an amount from the net income of a trust estate (target trust) for the purposes of section 109XA if:

- the private company is or becomes presently entitled to an amount from the net income of another trust estate (interposed trust) that is interposed between the target trust and the private company; and

- a reasonable person would conclude (having regard to all the circumstances) that the private company is or becomes presently entitled to the amount from the net income of the interposed trust solely, or mainly, as part of an arrangement involving an entitlement to an amount from the target trust; and

-

either:

- the interposed trust is or becomes presently entitled to an amount from the net income of the target trust; or

- another trust interposed between the target trust and the private company becomes presently entitled to an amount from the net income of the target trust.

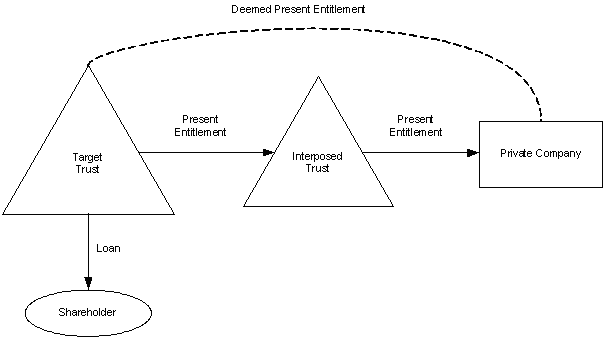

The diagram below, shows how section 109XI now prevents taxpayers circumventing the operation of section 109XA by deems there to be a present entitlement between the private company and the target trust:

Accordingly, if the conditions in section 109XI are satisfied (see below), then the amount which the private company is taken to be, or to become, entitled to from the net income of the target trust for the purposes of section 109XA is the amount (if any) determined by the Commissioner of Taxation (Commissioner).

That present entitlement is then taken into account for the purposes of the section 109XA.

Draft Taxation Determination TD 2010/D9 - The factors the Commissioner will take into account

On 15 December 2010, the ATO released a Draft Taxation Determination [i] setting out the factors the Commissioner will take into account in making this determination.

Broadly, the Draft Taxation Determination provides that when the Commissioner is determining the amount of present entitlement a private company has, or will have, from the net income of a trust estate under section 109XI, the Commissioner will take into account several factors occurring before the earlier of the following dates (determination date):

- the due date for lodging the target trust's income tax return for the income year in which the deemed payment or notional loan is made; or

- the date on which the private company lodges its income tax return for the income year in which the deemed payment or notional loan is made.

The factors that the Commissioner will take into account include the following:

- the extent to which the present entitlement to income from the target trust of (1) of the private company and (2) the interposed entity, remain unpaid immediately before the determination date;

- amounts included, by the determination date, in the assessable income of a shareholder of the company, as a result of the company's actual present entitlement to an amount from an interposed trust under Subdivision EA of the ITAA36 [ii];

- whether any part of the present entitlements of the private company represents consideration payable by the target trust or the interposed entity to the private company for anything;

- whether any payment of a present entitlement is a genuine transaction and not designed to avoid the application of Subdivision EA otherwise than as envisaged within the scheme of Division 7A.

Limitations in determining the amount of a deemed entitlement from a target trust

The amount the Commissioner determines to be the present entitlement of the private company from the net income of a trust estate under section 109XI cannot be more than the lower of:

- the amount to which any interposed trust is, or becomes, presently entitled to from the net income of another interposed trust or the target trust that remains unpaid at the determination time; or

-

the amount to which the company is, or becomes, presently entitled to from

the net income of the interposed trust that remains unpaid at the determination

time, less the following amounts:

- any amount that is included in the assessable income of a shareholder (or an associate of a shareholder) of the private company under Subdivision EA in respect of that actual present entitlement; and

- any amount of this entitlement that represents arm's length consideration payable to the company by the target trust or any interposed trusts referred for anything.

What are the next steps in finalising the determination?

The Draft Tax Determination was published on 15 December 2010 with public comments due by 4 February 2011.

Watch this space for any variations to the Draft Tax Determination, based on comments received.

Will the ATO's Determination apply retrospectively?

Once the Tax Determination is final it is likely to apply both before and after the date it is issued.

More information from Maddocks

For more information, contact Maddocks on (03) 9288 0555 and ask for a member of the Maddocks Tax and Revenue Team.

More information from Cleardocs

Read about the Cleardocs Division 7A Loan Agreement

Order a Cleardocs Division 7A Loan Agreement

Download a checklist of the information you need to order Cleardocs Division 7A Loan Agreement

[i] Draft Taxation Determination TD 2010/D9.

[ii] This Subdivision deals with unpaid present entitlements.

Read Our Latest Articles

Company Registration

Overview of some things to consider when registering an Australian company

customer support

legal advice

-

The legal information and commentary on this site is general only. Documents ordered through Cleardocs affect the user's legal rights and liabilities. To assess their suitability for the user, legal accounting and financial advice must be obtained.