This article is more than 36 months old and is now archived. This article has not been updated to reflect any changes to the law.

clearlaw

ATO publishes draft taxation determination on interposed entity rules in Division 7A

The ATO recently published a draft determination [i] that proposes to clarify:

- the application of the interposed entity rules in section 109T; and

- the amount of any deemed payment or notional loan that a private company is deemed to have made.

The importance of the Draft Taxation Determination

The interposed entity rules in Division 7A are very complex. This Draft Taxation Determination allows private companies to better understand how the Commissioner determines the amount of any deemed payment or notional loan made by a private company to one of its shareholders, or to an associate of one of its shareholders, through an interposed entity. Those payments are made under section 109T of the ITAA 36.

Remind me: how does Division 7A work?

If Division 7A of the ITAA 36 applies, then certain payments, loans and forgiven debts that a private company arranges for its shareholders or their associates are deemed to be unfranked dividends. You can read a brief outline of Div 7A here

Remind me: how does section 109T work?

Section 109T of the ITAA 36 deems a private company to have made a payment or loan to an entity (target entity) for Division 7A purposes if:

- the private company makes a payment or loan to another entity (interposed entity) that is interposed between the private company and the target entity; and

- a reasonable person would conclude (having regard to all the circumstances) that the private company made the payment or loan solely, or mainly, as part of an arrangement involving a payment or loan to the target entity; and

-

either:

- the interposed entity makes a payment or loan to the target entity; or

- another entity interposed between the private company and the target entity makes a payment or loan to the target entity.

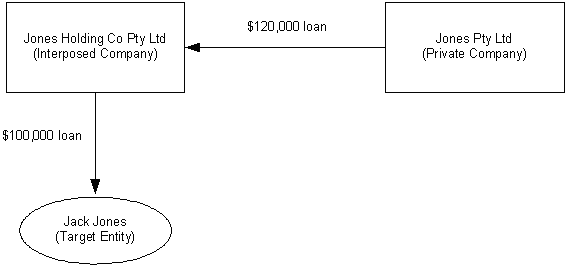

Diagram of the relationship between the entities in S 109

The diagram below shows how this arrangement works.

If the section 109T conditions are satisfied, then the Commissioner of Taxation (Commissioner) will determine the amount of the payment or loan deemed to have been made by the private company for Division 7A purposes.

Draft Taxation Determination 2010/D10: in brief

On 15 December 2010, the ATO released Draft Taxation Determination 2010/D10 [ii] setting out the factors the Commissioner will consider in making this determination.

Broadly, the draft provides that in determining the amount of any deemed payment or notional loan made by a private company under section 109T, the Commissioner will take into account several factors occurring before the earlier of the following dates (lodgement date):

- the due date for lodgement of the private company's income tax return for the income year in which the deemed payment or notional loan is made; or

- the date of lodgement of the private company's income tax return for the income year in which the deemed payment or notional loan is made.

The factors that the Commissioner will take into account include the following:

- the amount that the interposed entity loaned or paid to the target entity under the arrangement;

- whether any part of the loan or payment made to the target entity represents consideration payable by the private company or the interposed entity to the target entity for anything;

- if the private company has made a notional loan, whether any part of the loan has been repaid by the lodgement date;

- whether a Division 7A loan agreement has been entered into by the private company and the interposed entity by the lodgement date in respect of the payment or loan made by the private company to the interposed entity; and

- whether the arrangement is a genuine transaction that is not designed to avoid the application of Division 7A.

Example provided in the Draft Taxation Determination

The Draft Taxation Determination provides the following example to illustrate how the Commissioner will make his determination under section 109T:

Facts of the example

- On 15 September 2010, Jones Pty Ltd makes a loan of $120,000 to Jones Holding Co Pty Ltd. No Division 7A loan agreement was entered into by the parties at the time the loan is made.

- On 30 April 2011, Jones Holding Co Pty Ltd in turn lends $100,000 to Jack. Jack is a shareholder of Jones Pty Ltd.

- On 2 July 2011, prior to Jones Pty Ltd's 2010 lodgement date, Jones Pty Ltd and Jones Holding Co Pty Ltd enter into a Division 7A loan agreement in respect of the loan made on 15 September 2010.

Analysis of the example

A reasonable person would conclude that Jones Pty Ltd loaned $120,000 to Jones Holding Co Pty Ltd solely or mainly as part of an arrangement involving a loan to Jack. Section 109T would therefore apply to treat Jones Pty Ltd as having made a notional loan to Jack.

In determining the amount of this notional loan, the Commissioner would take into account the fact that Jones Pty Ltd and Jones Holding Co Pty Ltd have entered into a Division 7A loan agreement. The effect of this is that the amount of the notional loan deemed to have made by Jones Pty Ltd to Jack would be reduced by $100,000. This would result in a notional loan with a value of nil.

Will the ATO’s Determination apply retrospectively?

Once the Determination is finalised, it is proposed to apply retrospectively to all arrangements entered into both before and after the date of its issue.

Invitation for public comments

The ATO has invited public comments on the Draft Taxation Determination. All comments must be received by the ATO on or before 4 February 2011.

More information from Maddocks

For questions or more information about the above article, please call Maddocks in Melbourne (03 9288 0555) and ask for a member of the Maddocks Tax and Revenue Team.

More information from Cleardocs

Read about the Cleardocs Division 7A Loan Agreement

Order a Cleardocs Division 7A Loan Agreement

Download a checklist of the information you need to order Cleardocs Division 7A Loan Agreement

[i] Draft Taxation Determination TD 2010/D10

[ii] Draft Taxation Determination TD 2010/D10

Read Our Latest Articles

Company Registration

Overview of some things to consider when registering an Australian company

customer support

legal advice

-

The legal information and commentary on this site is general only. Documents ordered through Cleardocs affect the user's legal rights and liabilities. To assess their suitability for the user, legal accounting and financial advice must be obtained.