This article is more than 36 months old and is now archived. This article has not been updated to reflect any changes to the law.

clearlaw

ASIC to increase training standards for AFS licensees

On 23 June 2013, ASIC released Consultation Paper 212 Licensing: Training of financial product advisers - Updates to RG 146 (CP 212). CP 212 proposes increasing training standards for persons who provide financial product advice by introducing 2 new training regimes. These are proposed to come into effect in 2015 and 2019 respectively.

Specifically, CP 212 proposes increases in an adviser's:

- generic knowledge requirements;

- specialist knowledge requirements for financial planning, securities and superannuation;

- skill requirements for personal advice; and

- educational level requirements.

Submissions to ASIC in relation to CP 212 close on 30 September 2013. As part of the consultation process, ASIC is also seeking feedback on the timeframe for implementing the proposed new training standards.

Kate LattaOn 24 June 2013 the Australian Securities and Investments Commission (ASIC) proposed an increase in the knowledge and skill requirements for financial planners - and other persons holding an Australian financial services (AFS) licence - by the release of Consultation Paper 212 Licensing: Training of financial product advisers - Updates to RG 146 (CP 212).

Will CP 212 apply to the new limited AFS licence?

Yes: holders of a new limited AFS licence will be required to meet all relevant training requirements set out in CP 212 if ASIC ultimately adopts those requirements. Accordingly, the changes will be relevant to all AFS licensees who advise retail clients.

The new limited AFS licence was the subject of 2 recent ClearLaw articles:

- The first article discusses the new regulations and can be viewed here.

- The second article discusses ASIC's guidance on the new limited AFS licence and can be viewed here.

Both articles discuss the appeal of these limited licences to accountants who advise in relation to superannuation and a limited range of other financial products.

Overview of current training standards

Currently the training standards and skill requirements for AFS licensees and representatives who provide financial product advice to retail clients are prescribed by Regulatory Guide 146 Licensing: Training of financial product advisers (RG 146).

All advisers must comply with these training standards unless they fall within certain limited exceptions. Under RG 146, training standards and skill requirements vary depending on the services provided by the adviser, for example, whether the adviser provides personal or general advice and whether they advise on Tier 1 financial products (all financial products except Tier 2) or Tier 2 (basic banking products and non-cash payment products).

Currently, Tier 1 education levels are set at a 'Diploma' and Tier 2 education levels are equivalent to a 'Certificate III' as recognised by the Australian Qualifications Framework (AQF). At a minimum, advisers must meet licensing requirements by:

- completing a RG 146 training course through a training organisation listed on ASIC's Training Register; and

- meeting annual continuing education requirements.

Proposed new training standards

CP 212 proposes changes to the training standards that are set out in RG 146 by increasing the knowledge and skill requirements for AFS licencees (see Regime B and Regime C below). RG 146 proposes an increase in generic knowledge requirements, specialist knowledge requirements for financial planning, securities and superannuation, and the requirements for licencees' educational level.

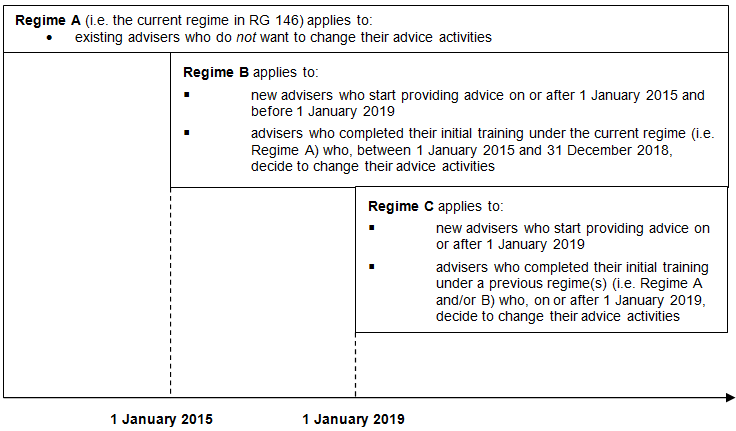

Under the intended framework, 3 standard training regimes will be available. These are set out in a helpful diagram in CP 212 as follows:

CP 212 propose to increase the educational level requirements in accordance with the relevant regime as follows:

|

Regime A |

Regime B |

Regime C |

|||

|

Tier 1 |

Tier 2 |

Tier 1 |

Tier 2 |

Tier 1 |

Tier 2 |

|

AQF Level 5 Diploma |

AQF Level 3 Certificate III |

AQF Level 6 Advanced Diploma |

AQF Level 4 Certificate IV |

AQF Level 7 Bachelor Degree |

AQF Level 5 Diploma |

How does this affect me?

CP 212 will affect any person who intends to start providing financial advice in the future or any person who is looking to change their advice activities.

Circumstances in which an adviser changes their activities include a decision by an adviser, after they have completed their initial training, to:

- add a new area of specialisation to their advice activities when they are already training in other products in the same tier; or

-

change the type of advice they want to provide. That may include a:

- change from providing general advice to providing personal advice; or

- change from advising on Tier 2 products to advising on Tier 1 products.

Consultation Process

By 30 September 2013, any person who wishes to comment on CP 212 and the proposed changes should provide their submissions to:

Nicole Chew

Lawyer, Financial Advisers

Australian Securities and Investments Commission

Address: Level 5, 100 Market Street Sydney NSW 2000

Facsimile: 02 9911 2414

Email: policy.submissions@asic.gov.au

More Information from Maddocks

For more information, contact Maddocks on (03) 9288 0555 and ask to speak to a member of the Superannuation and Financial Services team or the General Commercial team.

More Cleardocs information on related topics

You can read earlier Clearlaw articles concerning companies here.

Order Cleardocs document packages

- Limited AFS Licence Application

- Company Registration

- Registration Documents Only

- Sole Director Package

- Change to Constitution

- Division 7A Loan Agreement

- Company Name Reservation

- Public Company Limited by Guarantee

- Deed of Confidentiality

Read Our Latest Articles

Professional adviser related

Electronic Signatures: ASIC’s Digital Shift – What It Means for You

Professional adviser related

Doing Good, By the Book: How to Start a Charity (Properly) - Part 2

Professional adviser related

From Exemption to Expectation: Anti-Money Laundering’s Professional Turn

customer support

legal advice

-

The legal information and commentary on this site is general only. Documents ordered through Cleardocs affect the user's legal rights and liabilities. To assess their suitability for the user, legal accounting and financial advice must be obtained.